NGEU and its purpose in CE/SEE and beyond

The NGEU instrument goes beyond post-crisis reconstruction. It offers a lot of potential to overcome dividing lines in Europe (East/West, South/North). Is it also turning from a small scale instrument into a big one, as the EIB used to do? Comprehensive assessments will be needed in the mid-2020s to make meaningful decisions in this respect.

COVID-19 crisis: Just another building block in the EU crisis history?

The EU and its members have been hit by numerous existential crises in the last decade (e.g. global financial crisis, subsequent Greek and sovereign debt crisis, migration crisis and Brexit). Then came the COVID-19 pandemic. In all crises before, it did not always look like Europe could deliver swift and meaningful policy decisions. This was different in the context of the COVID-19 crisis. The Next Generation EU (NGEU) Instrument laid the foundation for a vision- and mission-oriented economic policy. The NGEU instrument is about post-crisis reconstruction (partly linked to COVID-19 crisis costs), but above all supporting the twin transformations in the areas of greening the economy and digitalization. Moreover, this move strengthened confidence in the EU and in its perceived ability to manage crises inside the euro area and beyond.

The largest beneficiaries in CE/SEE are Romania, Croatia, Bulgaria and Slovakia. It is expected that NGEU funds will strongly support convergence, while overall political dimensions shall not be underestimated. As of early 2022, Croatia, Slovakia, Czechia and Romania are in the lead in absorbing EU funding, with — not entirely surprising — laggards being Bulgaria, Poland and Hungary. Poland and Hungary currently do not seem particularly ambitious to absorb the NGEU funds at any price, while some EU states want to focus even more on rule of law issues here. At present, this is not yet an issue for Poland and Hungary, as financing is still cheap and easily available on international financial markets. This could change in the 2020s, however, as financing costs have already risen on the local markets in recent months.

NGEU & RRF: Much more than just a post-pandemic recovery tool

With the NGEU instrument (and here above all the Recovery and Resilience Facility, RRF), an (initially temporary) initiative was created to boost the low long-term potential growth of some Western European EU countries (compared to peers) and enhance economic and social convergence within the EU in times of transformation (e.g. in the digital space or in regard to greening the economy).

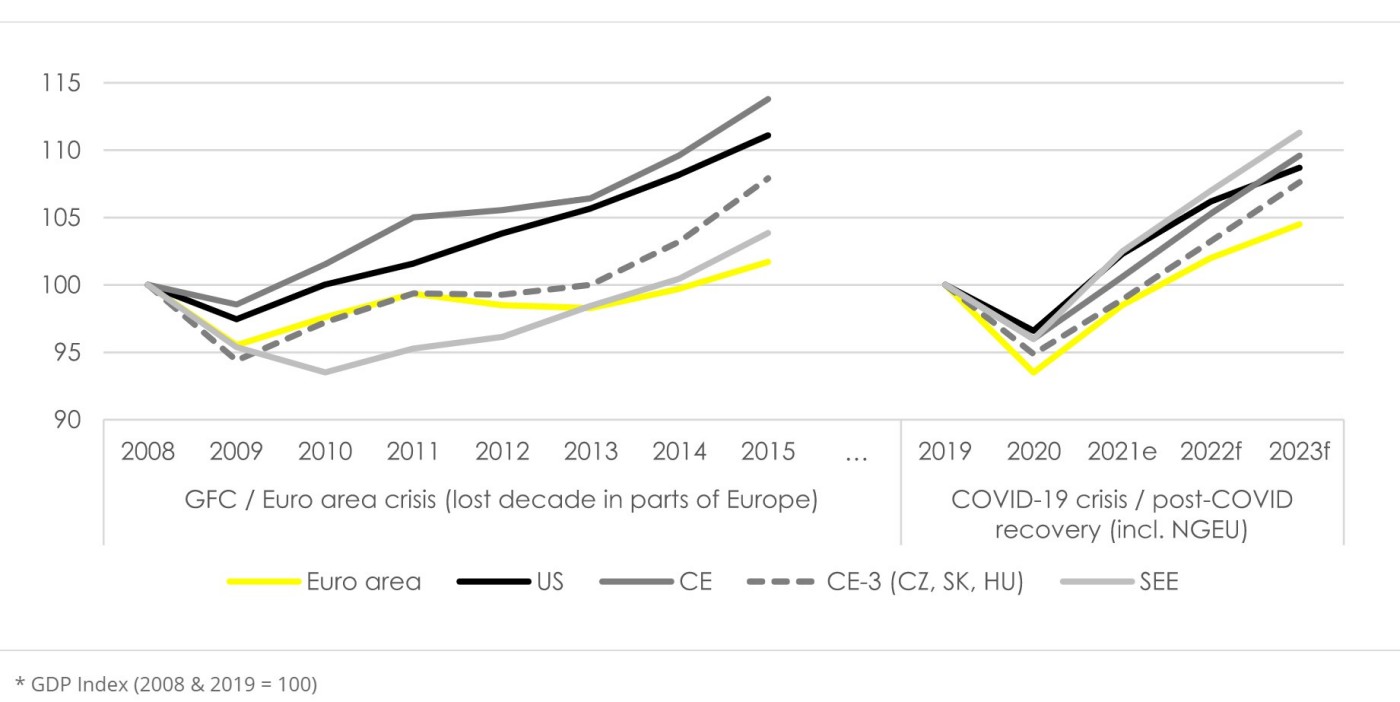

Two different recovery periods and policy responses*

The NGEU instrument — although launched during the COVID-19 pandemic — should therefore not be seen as a mere response to the pandemic, but as an initiative to strengthen the EU project as a whole. On the one hand, the NGEU instrument acts as a substitute for a non-existent central fiscal stabilization capacity in the EU/euro area (that can induce substantive cross-country spillovers on top of stabilization at the national level). In this way, a so-called lost decade as in the aftermath of the global financial and euro area crisis (compared to the USA, for example) in larger parts of the euro area and EU economy should be avoided. Our current growth projections show that this should clearly be within the realm of possibility. And even though the NGEU instrument contains noticeable redistributive elements between EU members, we see a good chance that many firms from financially strong EU member countries with lower NGEU country allocations (Austria, Germany, France) will benefit substantially.

It was also intended to support less financially strong EU members in their modernization needs in order to counteract possible dividing lines in the digital and green transformation. For the CE/SEE countries, the NGEU instrument, together with regular MFFs, remains a key factor in their path to closing the gap and increasing integration with Western Europe. The climate transition is yet another challenge in this regard as the CEE counties are again lagging here, therefore the NGEU program with the climate focus is of high importance. Also, digital transition (key pillar of NGEU) gains on importance as the CE/SEE countries are looking for a new competitive edge beyond the relatively cheap labour force and try to move up the value chain both within the well-developed manufacturing specialization, and beyond it (in R&D in particular). That said, distributing the NGEU/MMF money wisely and effectively is important with this entirely new focus, and the new EU member states in CE/SEE should strive to avoid mistakes that have led to weak absorption or inaccurate allocation in the past. Overall, in our opinion, the NGEU instrument is an important project to strengthen convergence in the EU — also between Western and Eastern EU members — and at the same time to counter the partly recognizable frustration in Western Europe with regard to democracy, perceived corruption and the rule of law in some CE/SEE countries.

From a broader perspective, the NGEU instrument also promotes the EU as a globally important issuer on international debt capital markets, especially for Green Bonds. This holds true for overall outstanding volumes and in the Green bond segment in particular. It seems rather unlikely to us that building such a position will be just a one-off. Whether the EU will remain an important issuer of very long-dated bonds or more in the short- to mid-term segment depends on the future policy course that has to be hammered out later in 2020ies as will be shown later. We should recall here that the then German Finance Minister and now Chancellor referred to the so-called historical “Hamilton moment” in 2020, echoing the (18th century) US Secretary of the Treasury (Alex Hamilton), who pushed through debt communalisation in the US back then.

On a side note, the EU has to some extent mirrored the NGEU project in the Western Balkans, respectively in the (potential) EU accession countries (via the Investment Plan for the Western Balkans), which is important to ensure modernization along with EU priorities and the accession readiness of these countries.

NGEU: Litmus test is looming in the mid-2020s

So far, hardly any NGEU funds have flowed. This should change soon. Already in 2022, 40-50% of the funds could flow, some countries could have allocated the majority of the funds by 2023. In this respect, it shall be possible to review the success of the NGEU instrument by mid 2020. A precise and empirical evaluation will then be indicated. It will be a question of which EU members were particularly successful, what were the driving forces at play here, how much progress has been made in growth and transformation? It is also important to answer questions about macroeconomic effects beyond the level of individual nation-states, such as how large so-called additional spillover effects of this simultaneous expansionary fiscal and monetary policy across the whole of Europe were.

The much-needed economic analysis along the lines sketched previously and to be conducted in the mid-2020s, which should certainly not only be of a normative-political nature, will possibly determine whether the NGEU instrument will become more than just a temporary instrument. If not, at least an instrument has been created in the sense of EU policy logic that will make it possible to respond to economic crises in the future. Furthermore, the European Commission has certainly been strengthened vis-à-vis the member states, while the receipt of funds from the RRF is linked to the implementation of reforms and the fight against corruption, mismanagement of EU funds and conflicts of interest, in addition to investment priorities along EU lines.

Taking a longer-term perspective, small scale can become big at the EU level. As is well known in EU policy circles, the EIB was created in the 1960s to support Italy. In the early years, most of the EIB's money (60%) went to Italy for infrastructure development; today, the EIB is one of the largest global multilateral development banks as well as a key policy institution at the EU level. What will become out of the NGEU instrument is not yet clear. However, the NGEU instrument offers “reconciliation” with Europe on many levels. It can help to bridge West/East and North/South divides, reposition the EU as an economic “convergence machine” and at the same time bring the issues of the rule of law and EU governance even more into the political spotlight. A certain frustration with the EU project in Western Europe stems precisely from the corruption problems plus the rule of law disputes in/with some CE/SEE countries, in combination with the perceived powerlessness of the EU here. If progress were to be made in this regard, it would be in the interest of the EU and above all the remaining EU accession candidates. In order to achieve progress in the dimensions outlined, reforms in the EU decision-making and the will to enforce them are needed. Progress in the institutional sphere and the dimensions sketched previously plus in twin transformations agendas (digital & green) are also important building blocks for progress in other key EU agendas, such as “strategic sovereignty”. Whether the NGEU instrument was supportive for progress in such “softer” political dimensions will also have to be analyzed in detail in the 2020s. The jury is still out, but there is reason for optimism. And that is the point of a vision- and mission-based (economic) policy.

For more Details see our comprehensive CEE Insights: NGEU as a generous source plus great opportunity for EU & CE/SEE (for registered users only).